Tariff News and Insights

Tariffs are taxes that governments put on imported goods. They sound technical, but they show up in the price you pay for everything from phones to fresh fruit. When a country raises a tariff, the cost of the imported item usually goes up, and local sellers often pass that extra charge onto you. Understanding the basics helps you see why your grocery bill might jump after a trade decision.

How Tariffs Affect Everyday Prices

Imagine you buy a smartphone made abroad. If your government adds a 10% tariff, the retailer has to pay more to bring that phone in. To keep profit margins steady, they’ll likely increase the retail price by a similar amount. The same logic works for groceries, clothing, and even cars. In many cases, the extra cost can be felt right away, especially for products that rely heavily on overseas production.

Small businesses feel the squeeze too. A local shop that imports specialty coffee beans might see its cost rise, forcing it to either raise prices or cut margins. Larger companies can absorb some of the hit, but they often shift the burden to customers. The ripple effect can influence everything from wages to inflation, making tariffs a hot topic for policymakers and everyday shoppers alike.

Recent Tariff Moves You Should Know

Last month, the G7 finance ministers announced new sanctions that include higher tariffs on nations buying Russian oil. The move targets big buyers like India and China and aims to curb revenue flowing to Russia. While the primary goal is political, the side effect is higher fuel prices for many countries, which eventually trickles down to transport costs and, ultimately, the price of goods on store shelves.

Across the Atlantic, the United States is reviewing tariffs on certain tech products after the launch of the iPhone 17 Air. Industry analysts say that any new duties could add a few dollars to the retail price, which matters for budget‑conscious consumers. Keep an eye on official announcements, because even a small change can shift market dynamics quickly.

In South Africa, the local government is debating a tariff adjustment on imported raw materials used in manufacturing. If approved, manufacturers might see higher production costs, which could affect the price of locally made goods. Traders and investors are watching the debate closely, as it could signal broader shifts in trade policy.

So, what can you do when tariffs push prices up? First, compare local alternatives. Sometimes a domestically produced product isn’t subject to the same taxes and can be cheaper. Second, watch for sales that offset tariff hikes—retailers often run promotions to stay competitive. Finally, stay informed by following reliable news sources, because timely knowledge lets you plan purchases smarter.

Tariffs may seem like a distant policy issue, but they directly shape the cost of everyday items. By grasping how they work and staying updated on the latest moves, you can make better budgeting choices and avoid unpleasant price surprises. Keep checking back for fresh updates, expert analysis, and practical tips on navigating the world of trade taxes.

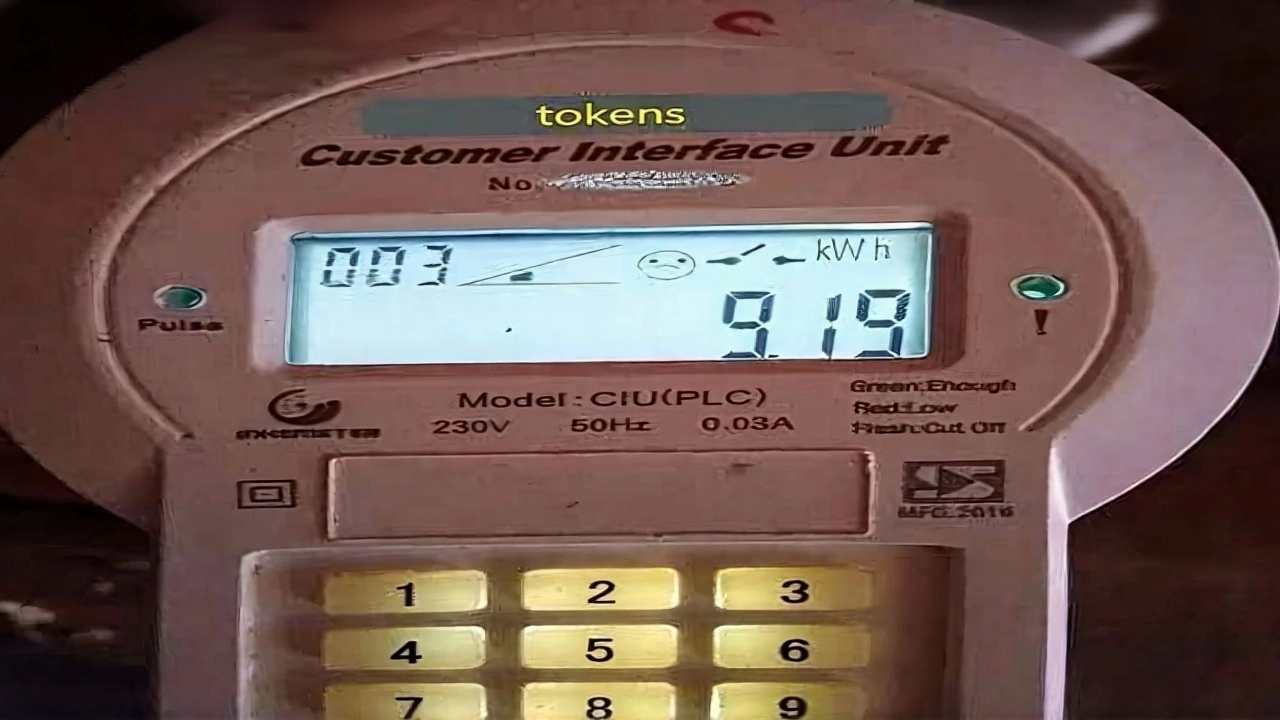

Why Kenya Power Tokens Vary: Rosemary Oduor Explains the Three‑Tier Tariff

Rosemary Oduor of Kenya Power explains why identical token payments yield different units, citing a three‑tier tariff based on three‑month average use. Consumers demand clearer alerts and tools.

More